Angus Campbell

BSM Director Energy Projects

Navigating through the complexities of scrubbers

Bernhard Schulte Shipmanagement (BSM) takes the lead in advising owners on the complex maze of information and arguments currently gripping the industry.

It has been called the most important change in shipping for decades and is causing major controversy in the industry.

The debate between owners is based on two primary views. The first sees the fitting of scrubbers on their vessels as a smart way of meeting the International Maritime Organisation’s (IMO) low-sulphur fuel regulations, which will come into force in 2020. The second expresses caution about their use, saying they are a short-term solution, which does not address the central problem of how shipping cuts its sulphur emissions.

To address this, BSM provides individual, impartial advice to owners facing this pressuring issue, based on their needs, along with the knowledge and expertise of Schulte Marine Concept, the Company’s division on newbuilding, conversion and retrofit projects.

Currently, estimates suggest that more than 2,000 vessels — three to four percent of global shipping capacity — are set to be fitted with open-loop scrubbers to enable them to comply with the fuel regulations.

This contrasts with the number of vessels powered by Liquid Natural Gas (LNG), which today are about 260 vessels worldwide, comprising 121 ships in service and 132 on order.

The discussion on scrubbers will continue right up to and beyond the 2020 deadline, as currently there is no industry consensus.

While independent advisory and detailed market knowledge are central to BSM’s service, Angus Campbell, BSM Director Energy Projects, and Jens Alers, BSM Representative Bermuda, agree that open loop scrubbers are not a realistic long-term solution for the industry.

As Angus pointed out, “The decision to fit scrubbers on board a vessel will depend on a range of individual factors, such as the age of a vessel, where it trades, its type, etc. Our role as manager is to act as an advisor, offering the full range of information and intelligence available, so that the owner can reach a conclusion which is right for a particular vessel.”

Angus and Jens both believe that a significant industry change is taking place.

According to Angus, many people recognise that, “The IMO slightly distorted the issue by allowing the continued use of high-sulphur fuel oil.”

He added, “It would have been straight forward and better for the industry if IMO had made high-sulphur fuel oil illegal and forced the industry to use clean fuels. This would place us all on a level playing field.”

While BSM offers its expertise based on the needs of the owner and vessel, both Jens and Angus argue there are significant issues around scrubbers which could have profound long-term implications.

Jens said, “My considered opinion about scrubbers is that they are not a technology which makes sense to the majority of shipowners and their vessels. I am not saying that because I expect owners to resist the capital expenditure involved, but because the scrubbers themselves are a highly imperfect technology.”

He believes there are many problems with scrubbers, including environmental, commercial and technical drawbacks.

One issue arises from the wash-water that open-loop scrubbers flush back into the ocean. Not only does shipping fuel emit significant amounts of CO2, sulphur oxides and nitrogen oxides, but also particulate matter containing organic carbon, black carbon, polycyclic hydrocarbons and heavy metals. Leaving aside the environmental and commercial concerns, there is another issue which could ultimately damage the shipping industry, Angus says.

The general public is watching closely and therefore careful actions have to be taken moving forward as they will be seen in the ‘Court of Public Opinion’.

“The scrubber issue in shipping is now being raised by lobby group interests and is being discussed in mainstream media. The attitude towards scrubbers is negative and this could in turn impact shipping negatively.

“Public sentiment is moving against scrubbers and there could be quite a strong backlash. The whole issue of taking pollution from the air and putting it in the water will become hugely negative in terms of public perception,” he said.

One of the challenges in informing the public and various lobby group interests is that every ship will have a different solution for IMO 2020; some will burn distillates, while others will burn 0.5% compliant fuels. Angus believes that a greater provision of low sulphur fuels will be available in many ports post 2020.

Jens raises another significant drawback to scrubbers, the fact that their use on vessels will be limited and even outlawed in many jurisdictions.

“A significant number of jurisdictions have committed to ban such discharges by vessels. Ships will not be permitted to burn Heavy Fuel Oil (HFO) and use their scrubbers whilst in the territorial waters of those jurisdictions. This means, the vessels will need to reserve a much larger low sulphur fuel oil bunker tank capacity than they had originally envisaged.

“If between now and 2020 some of the more important jurisdictions decide to ban the presence of HFO on board vessels altogether, the owners who decide to invest heavily into scrubbers will have wasted their investment.”

Then there are the unforeseen costs arising from scrubber installation, says Jens.

“The use of scrubbers does not only increase bunker consumption, it also increases operating expenses, because a scrubber is a complex industrial piece of equipment which requires maintenance and spare parts,” he said.

Both industry experts believe that in many respects the scrubbers’ debate is peripheral to the main issue of how shipping will move to the widespread use of cleaner fuels in the longer-term.

“If you want to invest in the long-term future of the industry, then look even beyond liquefied natural gas (LNG), which will only be a ‘bridging fuel’ for the next 20-30 years to get us into the hydrogen economy.

“Hydrogen fuel cells will in my opinion be the prime drivers of vessels by 2040,” Jens said.

BSM is currently assisting a range of diverse customers to meet the IMO 2020 deadline. However, beyond 2020, BSM is heavily committed to moving the industry towards the use of cleaner fuels.

Angus believes vessels like MV Kairos, the world’s largest LNG bunker supply vessel delivered by BSM, and similar ones planned, are part of the solution providing the infrastructure needed for cleaner energy use in shipping.

BSM is further securing a cleaner future through the building of wind power Service Operations Vessels (SOVs) for the wind power sector.

Angus summed up, “We must find ways of looking forward, to predict how our industry will evolve and be able to meet our current and future customers’ needs, while protecting the environment. BSM’s customers of the future will be diversified and they will be looking at cleaner fuel options.

“This means BSM must look beyond 2020, to assess the best choice of vessel propulsion as the shipping industry develops ways to meet the global challenge of reducing its carbon footprint.”

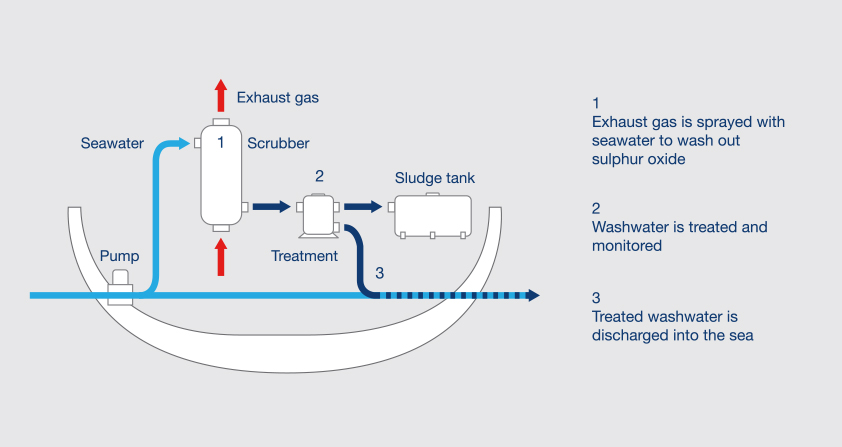

Open-loop scrubbers system process

Cargill is a long-standing and valued customer of BSM and a company with major stakes in the shipping industry. Over the past 18 months, Cargill has been busy preparing for the upcoming Global Sulphur Cap and setting its sights on no less than 100 percent compliance ahead of the implementation date.

Cargill is a long-standing and valued customer of BSM and a company with major stakes in the shipping industry. Over the past 18 months, Cargill has been busy preparing for the upcoming Global Sulphur Cap and setting its sights on no less than 100 percent compliance ahead of the implementation date.

An industry leader, its position on the installation of scrubbers has been formed after careful consideration and in close consultation with BSM.

BSM manages several Interlink Maritime vessels, which are on long-term charter to Cargill. The shipmanager has been able to provide Cargill with a holistic advice on how to approach the low-sulphur fuel regulation from a technology perspective.

Anda Cristescu, Operations Director for Cargill’s ocean transportation business, said, “We rely heavily on trusted partners like BSM to ensure our position is reasonable, attainable and in line with standard industry practice.

“BSM operates all managed vessels in the safest and most efficient manner to meet the requirements of shipowners, flag states, port states, class societies, charterers and other stakeholders in full compliance with the International Safety Management Code.”

Anda believes the successful management of vessels is only achievable with the close interaction between onboard personnel and highly experienced shore-based engineering and marine teams.

“We have found the maintenance of vessels to be our standard benchmark when we look towards trusted owners and peer leaders,” she said.

Anda added, “Cargill’s purpose is to nourish the world in a safe, responsible and sustainable way. In the maritime sector, we’re reaching higher and extending our influence to matters which are not typically addressed by a non-owning charterer.”

For Cargill the issue of the scrubbers’ use is complex.

“We’re taking a portfolio approach to compliance with IMO’s 2020 Global Sulphur Cap. We’re planning to run low-sulphur fuel blends on the vast majority of our fleet and use scrubbers where the size of the vessel and trade route make sense.”

She added that Cargill did its investigation on all types of scrubber units before committing to any investments.

“Scrubber technology is an efficient method of removing both sulphur and particulates from air emissions thereby protecting human health and reducing acid rain. Research studies from government organisations and independent companies conclude that scrubbers are safe and compliant with international regulations concerning ocean acidity and biodiversity.”

Anda also stresses that in the long-term Cargill is committed to achieving IMO’s greenhouse gas strategy.

“To achieve the IMO’s 2050 ambitions, as an industry, we need to explore new financing rules, carbon pricing methodologies, new technologies as well as refine our insurance agreements, charter-party contracts, and international legislation,” she concluded.